Written by Maureen Cureton and Ted Shabecoff

Published by EcoClaim

Greenhouse gas inventories, carbon dioxide equivalent, emissions scopes, quantifying and verifying CO2e…the world of business has adopted a whole new vocabulary over the past 20+ years.

Some may think this is science, not business –but make no mistake, greenhouse gas measurement and management are pivotal to decision making in leading businesses today.

Companies around the world measure their carbon footprint and share data on direct and indirect greenhouse emissions (GhGs) associated with their business. Much of this commitment to measure and disclosure has been voluntary as businesses recognize an annual inventory of their emissions can help inform planning, guide decisions about risk, drive operational efficiencies and inspire innovation. Furthermore, transparency about their emissions and their emissions reductions commitments can benefit their reputation

…But what are companies measuring?

Greenhouse gas inventories measure a smorgasbord of activities that generate GhG emissions directly and indirectly. Let’s break them down.

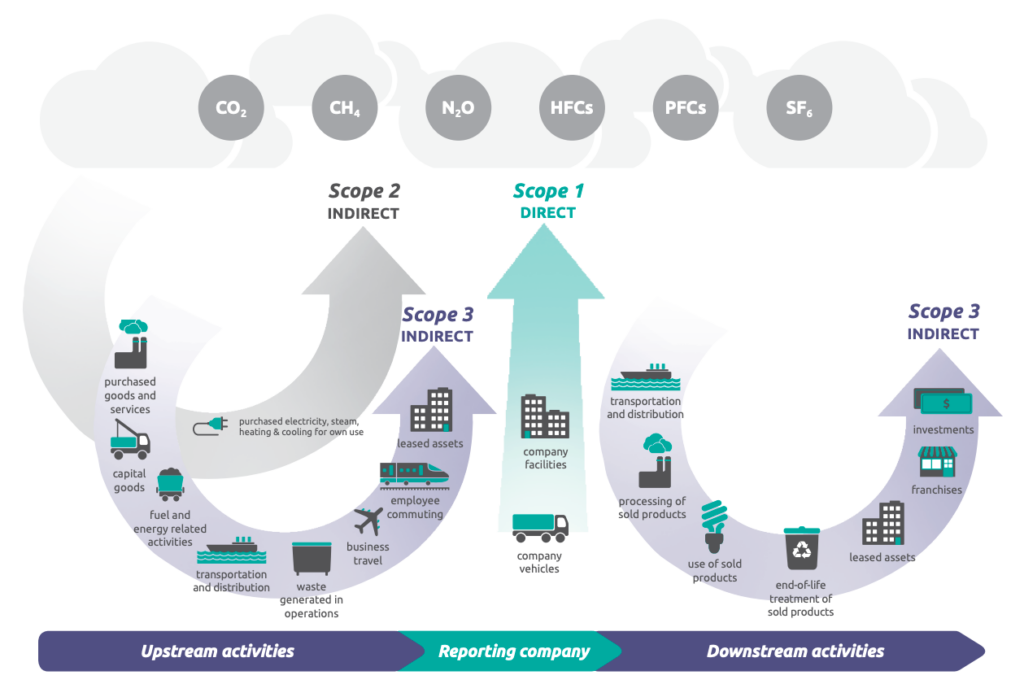

The categories of emissions labeled by the GHG Protocol Corporate Accounting and Reporting Standard are divided into three categories or scopes –creatively labeled: Scope 1, Scope 2 and Scope 3.

Scope 1 includes only direct emissions from owned or controlled sources of greenhouse gas emissions. Most commonly this includes emissions from fossil fuel combustion in boilers or furnaces, and emissions from the tailpipe of vehicles, or direct GhGs associated with other equipment and machinery.

Scope 2 primarily includes indirect emissions from the generation of purchased electricity. Scope 2 emissions are indirect, because they occur at the power utility where electricity is generated –not at the business or building where lights, plug loads and other electricity usage occurs. However, this merits its own category because every company or organization (and individual) relies on electricity. While a business may lack options for its electricity supplier, there are many ways they can control their purchased electricity consumption, such as by increasing energy-efficiency, implementing conservation measures, or shifting to solar or other renewable energy supply. So, Scope 2 represents an important area of opportunity for emissions reductions for many companies, and the GHG Corporate Standard indicates that all Scope 1 and 2 emissions must be reported.

Long neglected by many businesses, Scope 3 emissions were overshadowed by their better-known siblings, Scope 1 and 2. However, as data measurement capabilities improve, Scope 3 emissions are emerging as a hidden giant in the world of climate impact.

Scope 3 emissions encompass all other indirect emissions that occur within a company’s value chain. Long neglected and grossly under-reported, there are 15 sub-categories of Scope 3 emissions. Like Scope 2 emissions, GhG emissions in the Scope 3 category are considered indirect emissions because they are beyond a company’s direct control. Scope 3 emissions include categories such as waste, shipping, purchased goods, business travel, employee commuting, and for some companies–such as banks and insurers–their investments. These and other Scope 3 categories reflect indirect greenhouse gas emissions across a company’s value chain. That’s a lot to measure and manage!

Source: Scope 3 Standard, page 5.

Tracking of greenhouse gas emissions began as early as the 20th century, but formal measurement of businesses’ GhGs began in 2001, when the World Resources Institute (WRI) and the World Business Council for Sustainable Development collaborated with businesses to establish the GHG Protocol Corporate Accounting and Reporting Standard (sometimes called the WRI Protocol for short). Today companies of all sizes use this Standard to guide measurement and management of their GhG emissions.

For years, GhG reporting has been voluntary in most jurisdictions, but the Standard was clear that when reporting companies must include all Scope 1 and 2 emissions. It was a bit fuzzy about Scope 3 reporting responsibilities, so many companies took that as a hall pass to skip measuring Scope 3 emissions.

After all, Scope 1 and 2 emissions are relatively easy to measure, and companies may gain insights from this data to guide GhG reductions strategies and tactics. However, these direct and indirect emissions from your company’s operations are only the tip of the iceberg. The vast majority of the iceberg lies hidden beneath the surface –this represents Scope 3 emissions.

Depending on the company size, location and line of business, indirect emissions associated with suppliers, or emissions associated with investments or other value chain activities, can far eclipse Scope 1 and 2 emissions.

In 2011, the Corporate Value Chain (Scope 3) Standard launched to provide more specific guidance for measuring and reporting Scope 3 emissions. This Scope 3 Standard is the only internationally accepted method for companies to account for these types of value chain emissions, and it specifies that companies should “prioritize data collection efforts on the Scope 3 activities that are expected to have the most significant GHG emissions, offer the most significant GHG reduction opportunities, and are most relevant to the company’s business goals.”

With the emergence of Scope 3 emissions tracking by leading companies, the data is staggering. Some estimates indicate that Scope 3 emissions account for up to 70% of companies’ total carbon emissions. This percentage varies by sector. For example, research done by the Carbon Disclosure Project (CDP) estimates that, on average, Scope 3 emissions account for 99.5% of total emissions for companies in the financial services sector. Yet, according to a survey done by the Boston Consulting Group (BCG), “only 12% of organizations surveyed consider Scope 3 their top priority.”

While it may not be possible or practical to measure all Scope 3 emissions associated with a company’s value chain, it is important to capture those emissions that are material or significant to running the company. In determining if it’s important to track certain Scope 3 emissions, first consider: Do you think your company generates a significant amount of GhG emissions from a particular Scope 3 activity? Are the activities associated with those emissions critical to your company’s success? If you answer yes, these Scope 3 emissions are material and important, and should be measured annually.

Companies track income and expenses to know if they’re profitable and to identify financial pain points. Measuring GhG emissions but omitting large sources from the value chain is like neglecting large amounts of expenses in financial reporting. It provokes a false representation of the company’s performance and fails to provide important data to guide decisions to advance the company’s performance.

While many companies still focus on their Scope 1 and 2 emissions, the real game-changer lies in Scope 3 indirect emissions across their value chain. Measuring Scope 3 is the first step in unlocking reductions opportunities throughout the value chain, including through the choice of suppliers and vendors.

Leading companies use the data and information about their emissions sources as the impetus for developing a roadmap for reducing operating costs, increasing efficiencies, inspiring product or service innovation, attracting investors and employees, and enhancing a company’s reputation. A study by the Boston Consulting Group (BCG), reinforced that “the better a company measures its emissions, the more effectively it can reduce them”. In BCG’s study, 64% of companies that measure their full scope of emissions achieved significant GhG reductions. Companies indicated they foresee at least $1 million in annual benefits from emissions reductions; some of the large companies estimate benefits of $100 million or more! Companies also cite other co-benefits from reducing greenhouse gasses, including attracting top talent and enhancing their reputation or brand.

So, if emissions data provides valuable management information, why aren’t more companies measuring all their emissions?

Sure, measuring Scope 3 emissions offers a treasure trove of climate insights that can lead to emissions reductions and associated benefits, but obtaining accurate data can be a time-consuming expedition. The challenge lies in the complexity of a company’s value chain. Suppliers may lack reporting systems, data may be fragmented or inconsistent, and chasing this information may lead companies into a labyrinth of frustration.

While some data is better than none, inaccurate or incomplete Scope 3 figures can be misleading. This can result in misplaced priorities, missed opportunities, and reputational risks. Imagine making a business claim based on flawed data. That’s why robust and accurate reporting of key material areas of Scope 3 emissions is important. It equips companies with information to assess climate-related risks and opportunities, and helps inform reduction efforts.

It may be a challenge to establish reporting for your company’s full scope of emissions, but if leveraging this information leads to cost-reductions, efficiency improvements, stronger supplier relationships, enhanced reputation and contributes to climate mitigation – that’s a win for all.

Despite the potential benefits of measuring and managing corporate GhG emissions, too few companies are companies tracking their Scope 1, 2 and 3 emissions, and others do not measure at all. However, the corporate sector is facing increasing expectations for climate reporting from external stakeholders including investors, government and other business partners.

Investors integrate climate data and information into assessment of risk and opportunities, and governments recognizing that what gets measured gets managed are introducing GhG reporting requirements.

Climate reporting is now required by law in 40 countries including EU members, the UK, Canada, Australia, and Japan, with South Africa following soon.

Despite push back in some parts of the United States, California is leading the way with their Climate Corporate Data Accountability Act (SB 253), taking effect in 2026 for Scope 1 and 2 emissions, and 2027 for Scope 3 emissions disclosure.

While the pause continues on the US Securities Exchange Commission’s (SEC) proposed corporate climate disclosure requirements, it is likely that California’s regulations will drive companies to move toward more comprehensive GhG reporting. Of note, California’s SB 253 guidelines specify that reporting complies with the Corporate Value Chain (Scope 3) Standard. California mandates reporting Scope 3 emissions, irrespective of materiality, while other frameworks like the European Union’s CSRD, require materiality-based disclosures.

The European Commission adopted the Corporate Sustainability Reporting Directive (CSRD) in November, 2022. CSRD affects a broad range of larger companies within or associated with the EU. The requirement for double materiality means companies must make the connection between reporting the effects of climate on people and the planet and the financial impacts. The goal is to make businesses see how greenhouse gas emissions impact financial wellbeing, and that extends to Scope 3 value chain reporting.

Meanwhile, the International Sustainability Standards Board (ISSB) is developing a uniform standard for sustainability reporting, which will include climate reporting. The draft guidelines for the climate reporting requirements are available for public review and include guidelines for Scope 3 reporting, and they are working with other broader sustainability reporting frameworks, such as Global Reporting Initiative (GRI), to integrate these guidelines.

Many of the new laws are targeting larger corporations, although in Canada, climate-related reporting requirements for the financial sector will extend to smaller and medium-sized financial institutions beginning in 2026. This mandatory reporting requirement (B15) announced by Canada’s Office of Superintendent of Financial Institutions (OFSI), specifies requirements for disclosure of Scope 3 related emissions, including specific categories like investments.

All these new laws and directives aim to encourage companies to engage and measure emissions from their suppliers and other third-party organizations with which they work –and to use this information to drive down their own GhG emissions and emissions across their value chain.

While some companies may wait for the government to require Scope 3 reporting, others are recognizing there are risks and opportunities to unlock in their value chain.

Scope 1 and 2 emissions may influence actions such as building energy-efficiency upgrades, sourcing renewable energy supply, or fleet conversion to EVs –but for many companies the real game-changer lies in targeting Scope 3 indirect emissions in their value chain.

Measuring key areas of materials Scope 3 emissions is the first step to inform decisions. Companies may evaluate their suppliers and vendors –are they reducing their emissions? What about the choice of materials and shipping, or waste associated with the business?

Scope 3 measurement identifies and quantifies what’s going on beyond the immediate building and operations, who the company does business with, and how all those value chain emissions contribute to the total corporate footprint. The next step is to leverage that data and knowledge to find opportunities for significant GhG emissions reductions and other co-benefits.

So, what’s the buzz about Scope 3 emissions? They represent risks and opportunities, and measuring them helps companies to determine where to prioritize innovation and action.

EcoClaim™ transforms insurance claims into climate action with its innovative platform, offering industry-leading training, GHG management software, and a Carbon Exchange marketplace. Tailored for P&C insurers, EcoClaim replaces generic emissions benchmarks with precise claim-level data, empowering insurers to measure, manage, and reduce Scope 3 emissions effectively. The platform not only strengthens sustainability disclosures but also lowers claims costs, proving that the low-carbon way can also be the cost-efficient way.